It’s peak season, and your inbox is overflowing with invoices. The hours tick by as you manually enter data, cross-reference POs, and chase down approvals.

What if there was a way to break free from this cycle of inefficiency and reduce your invoice processing time by more than five times?

💡

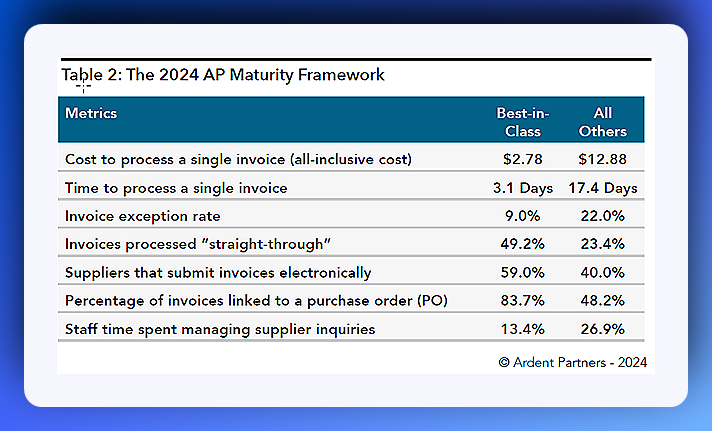

That’s the difference between an average company, which takes 17.4 days to process an invoice, and best-in-class organizations that have embraced automation, which takes just 3.1 days.

Imagine the potential impact this could have on your cash flow, your team’s productivity, and your financial decision-making.

Automated invoice processing uses advanced technologies like optical character recognition (OCR), artificial intelligence (AI), and machine learning (ML) to help you streamline your AP workflow, reduce errors, and accelerate the approval process. More than doing things faster, it’s about gaining control, visibility, and the ability to focus on what truly matters for your business.

In this comprehensive guide, we’ll explore the fundamentals of automated invoice processing; its key components, benefits, and best practices for implementation.

What is automated invoice processing?

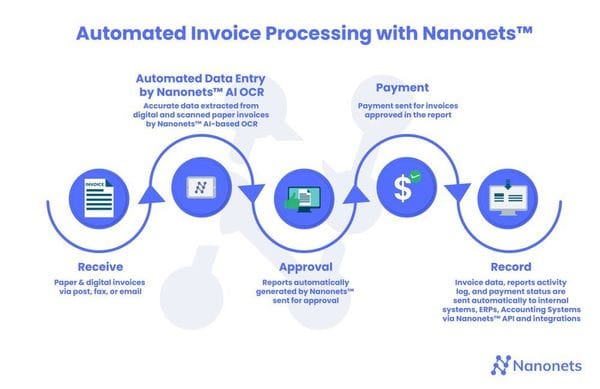

Automated invoice processing is a system that uses advanced technologies to streamline the entire accounts payable (AP) workflow, from data capture to approval and payment.

By automating invoice processing, organizations can:

💡

– Save costs and reduce manual labor

– Improve accuracy and reduce errors

– Accelerate processing times and payment cycles

– Enhance visibility and control over invoice status

– Ensure better compliance and audit readiness

– Ensure timely payments, reduce disputes, and provide greater transparency

OCR accurately extracts data from invoices, reducing manual data entry. RPA automates workflows based on predefined rules, eliminating repetitive tasks. ML algorithms learn from historical data to improve data extraction and validation, while AI handles complex decision-making and exception handling.

Automated invoice processing systems also seamlessly integrate with existing ERP and accounting systems, enabling smooth data transfer and reducing the need for manual intervention.

These technologies work together to create a streamlined, intelligent, and efficient AP process. Rather than replacing human employees, automation empowers AP pros to focus on higher-value activities like financial analysis, risk management, and proactive supplier relationship management.

How invoice automation works

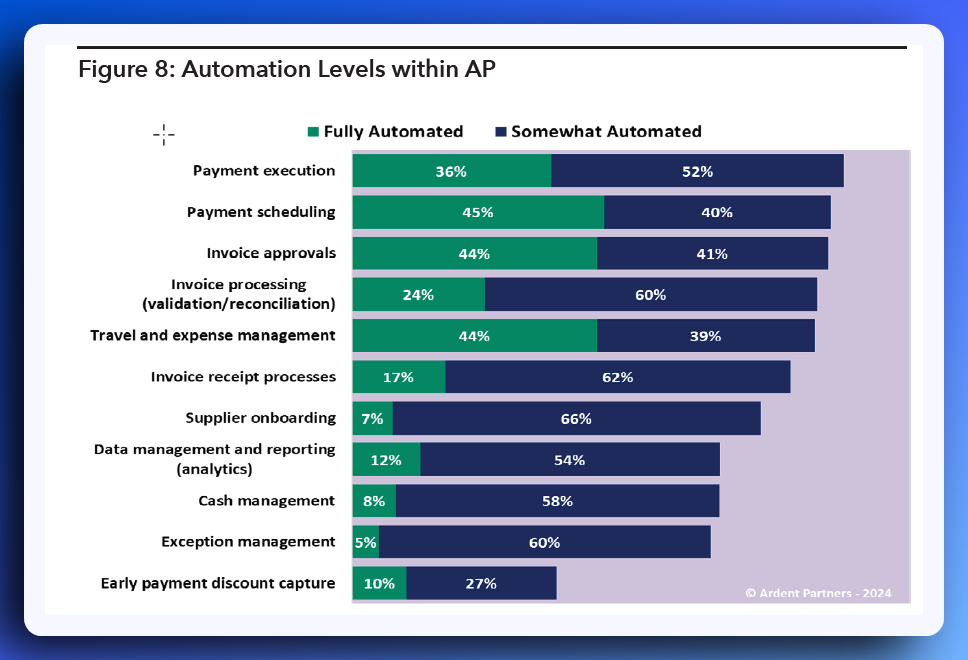

McKinsey estimates that over 60% of finance activities can be automated with current technology. While the adoption across companies have increased over the past years, the implementation bit usually differs based on the size and scale of the organization.

Some businesses may think a semi-automated approach might seem like a good starting point. This typically involves a mix of manual processes, spreadsheets, and basic automation tools. For example, you might receive invoices via email, then manually enter the data into a spreadsheet or use an OCR tool like ABBYY FineReader to extract invoice data. However, you still need to validate the data, match it against POs and receipts, and route it for approval manually.

While semi-automated systems can help reduce some manual effort, they often lead to broken workflows and inefficiencies. Users may need to switch between multiple tools or tabs, copy-pasting data from one system to another, leading to delays and potential errors. This approach often involves using tools like QuickBooks Online, Xero, and SAP Concur, resulting in a fragmented workflow.

This is where fully-automated invoice processing comes into play. These systems provide end-to-end automation of the invoice processing workflow, using advanced technologies like OCR, RPA, ML, and AI to handle every step of the process, from data capture to payment processing, within a single, integrated platform.

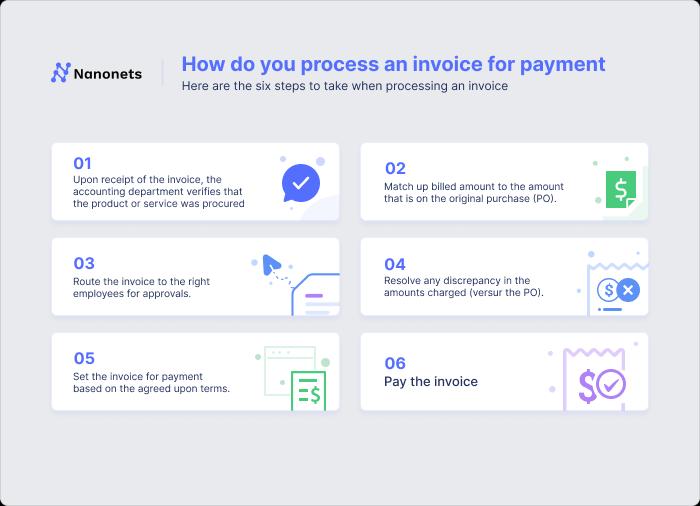

Here’s a closer look at how fully-automated invoice processing works:

Step 1: Invoice receipt and data capture

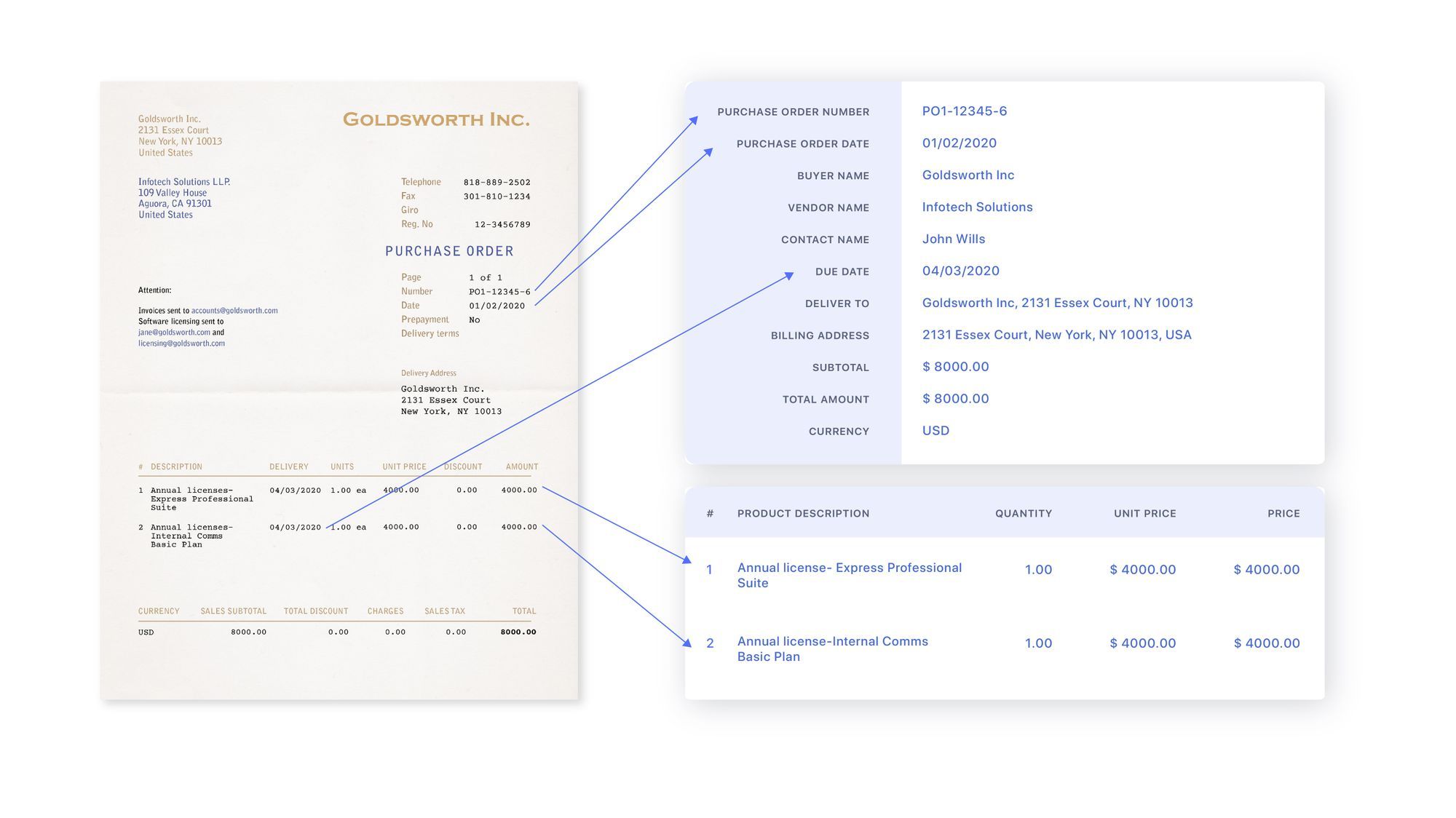

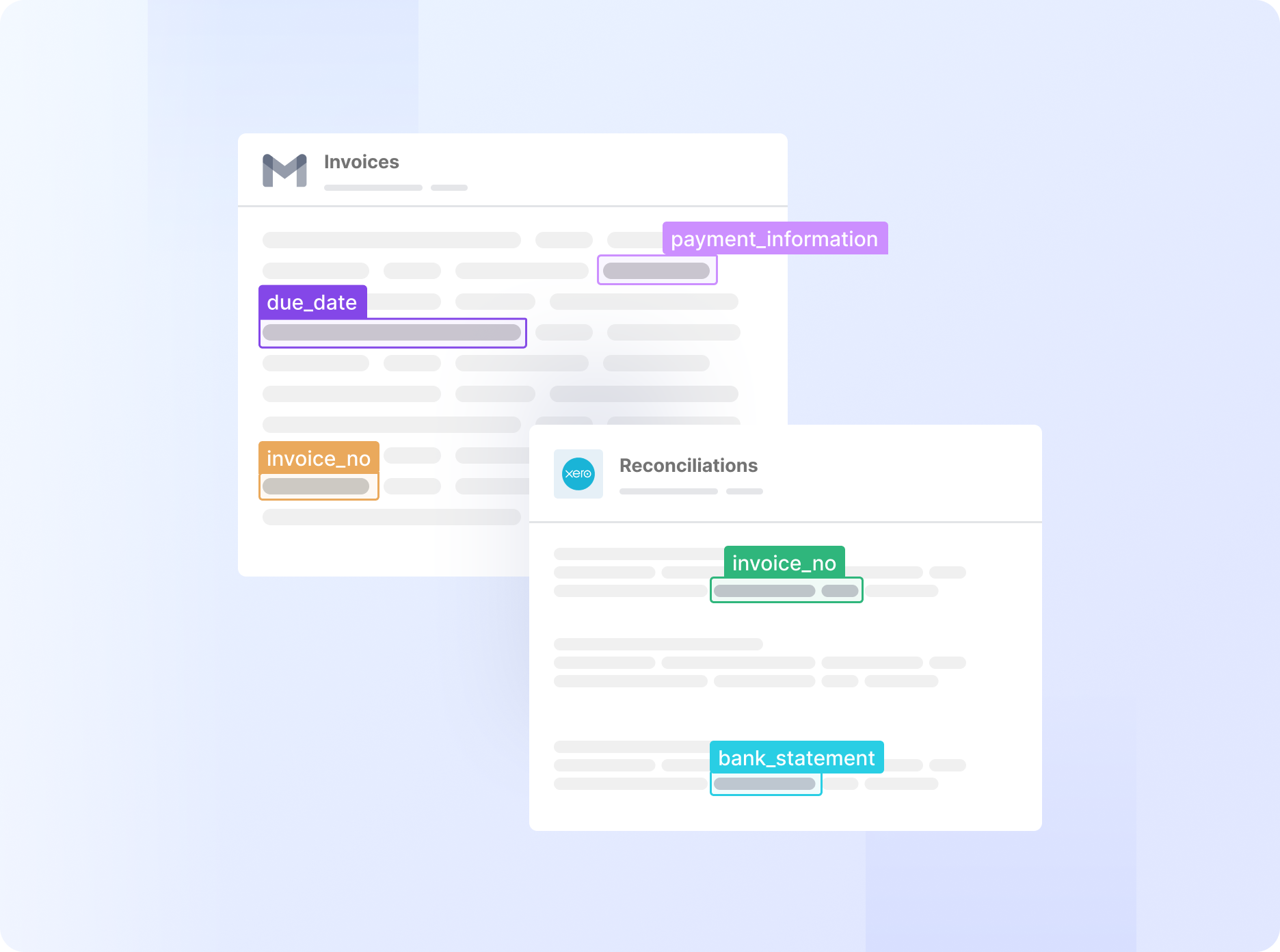

Invoices are automatically captured from various sources, such as email inboxes, supplier portals, or EDI systems. OCR technology, like the one used in Nanonets, extracts key information from the invoices, including vendor details, invoice numbers, amounts, and due dates. The extracted data is then validated using AI algorithms to ensure accuracy.

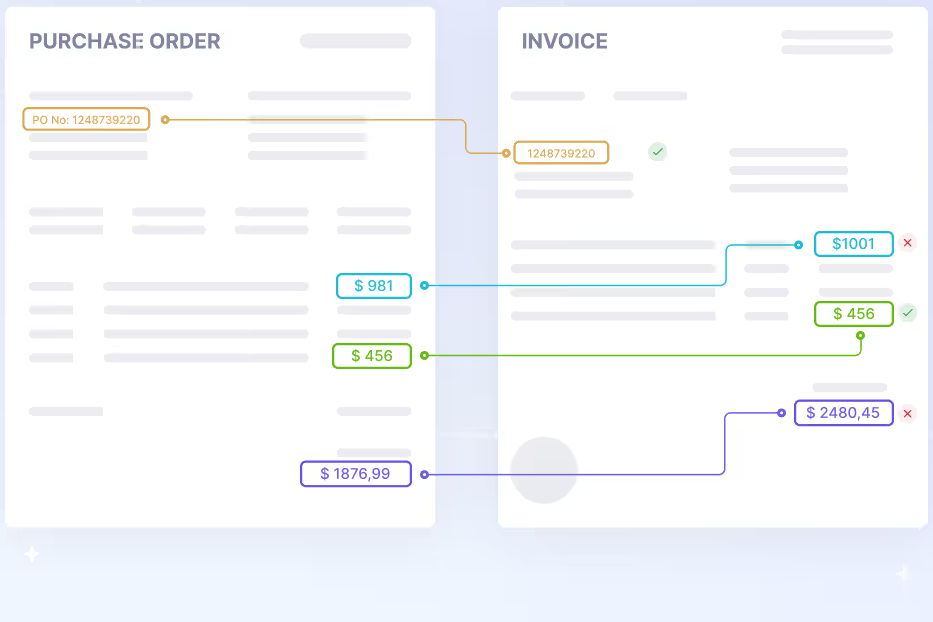

Step 2: Data validation and matching

The system automatically matches the extracted invoice data against POs and receipts using predefined rules. This process ensures that the invoices are valid and correspond to actual goods or services received.

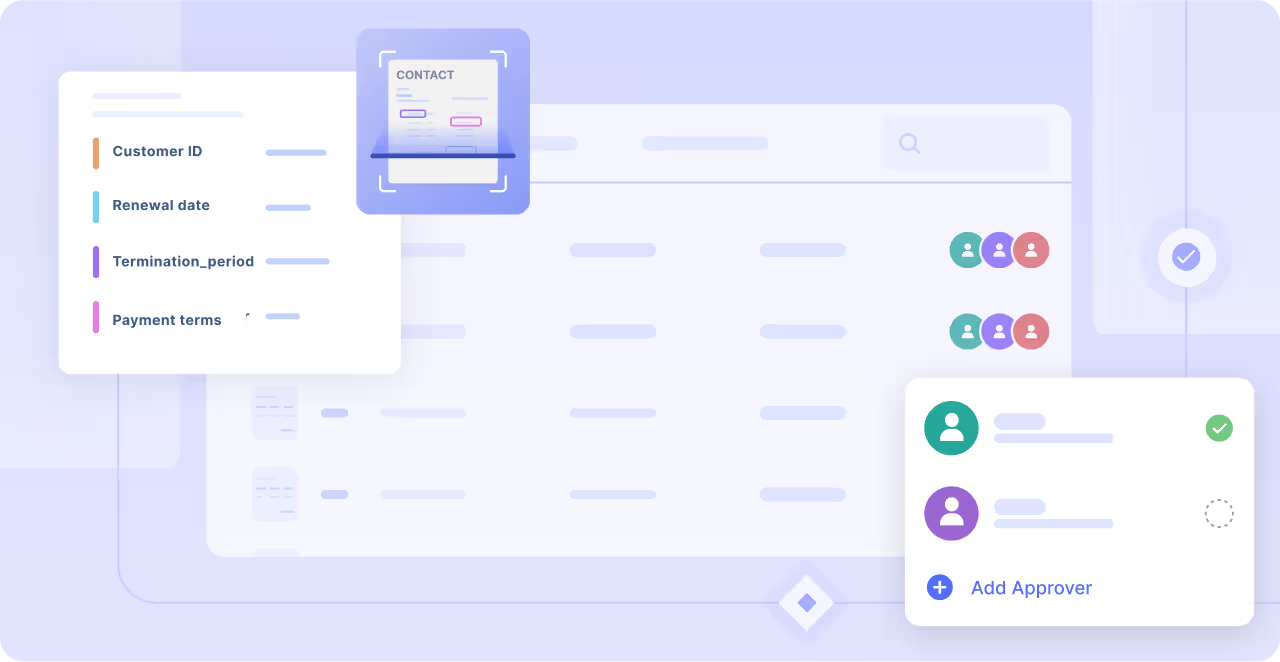

Step 3: Routing for approvals

Based on predefined approval hierarchies and rules, the system automatically routes invoices to the appropriate approvers.

For example, if an invoice exceeds a certain amount or belongs to a specific department, it can be routed to the relevant manager or CFO for approval. Approval workflows can be customized based on the organization’s specific requirements, ensuring compliance and reducing approval times.

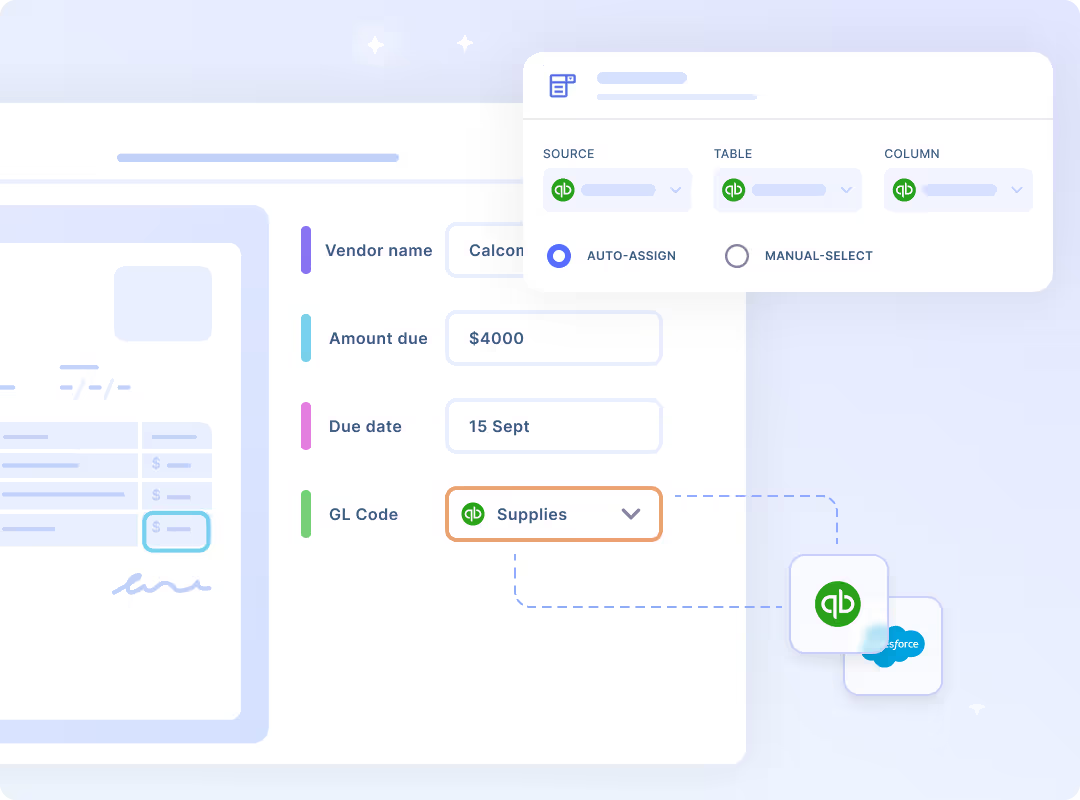

Step 4: Posting to ERP or accounting system

Once an invoice is approved, the system automatically posts the data to the integrated ERP or accounting system, such as Oracle NetSuite, Microsoft Dynamics 365, or SAP Business One.

This eliminates the need for manual data entry and ensures that financial records are always up-to-date. The seamless integration between the invoice automation system and the ERP software reduces errors and saves time.

Step 5: Payment processing and reconciliation

The invoice automation system initiates the payment process based on the predefined payment terms and methods. It can also handle reconciliation by matching the payments with the corresponding invoices, ensuring accurate and timely payment processing.

Here’s a quick overview of semi-automated and fully automated invoice processing workflows and how they differ:

| Process Area | Semi-Automated Processing | Fully Automated Processing |

|---|---|---|

| Processing Speed | 2-3x faster | 5-10x faster |

| Error Rate | 1-2% error rate | <0.5% error rate |

| Cost Savings | 30-50% cost reduction | 60-80% cost reduction |

| Staff Productivity | 50% time freed for analysis | 80% time for strategic tasks |

| Scalability | Requires new hires to scale | Can handle 5-10x volume |

| Payment Accuracy | 95-98% on-time payments | >99% on-time payments |

| Audit Readiness | Hours to prepare | Minutes to generate reports |

| Audit Readiness | Days to prepare | Hours to prepare |

Having an automated system ensures you’ve real-time visibility into invoice data. It empowers finance teams to make proactive decisions about cash flow. For example, they can identify invoices eligible for early payment discounts, optimize payment timing to maximize working capital, and quickly address any bottlenecks or exceptions that could delay payments. It also avoids giving suppliers a reason to send multiple invoice copies, which can lead to confusion and duplicate effort.

These fully-automated invoice processing system enable businesses to streamline their AP processes. You can reduce manual effort and achieve significant cost savings. Companies that have adopted fully-automated invoice processing have reported a reduction in processing costs and an improvement in processing times.

Best practices for successful invoice automation implementation

Implementing a fully-automated invoice processing system is not just about choosing the right technology. To truly enjoy the benefits of automation, you need to follow best practices that ensure a smooth transition and optimal performance.

Here are five key best practices to keep in mind:

1. Establish clear approval hierarchies and rules

By clearly defining who needs to approve invoices based on factors like amount, vendor, or department, you can make the approval process more efficient and ensure compliance.

For instance, you can set up an approval rule that requires all invoices over $10,000 to be approved by the CFO, while invoices under $1,000 can be automatically approved if they match the corresponding PO and receipt. This helps prevent unauthorized spending and reduces the risk of fraud.

Implementing clear approval hierarchies and rules can reduce approval times, enabling faster processing and payment of invoices.

2. Maintain accurate vendor and PO data

To ensure smooth invoice matching and validation, it’s crucial to maintain accurate vendor and PO data in your system. This includes regularly updating vendor information, such as contact details, payment terms, and tax IDs, as well as ensuring that POs are created and approved in a timely manner.

By keeping your vendor and PO data up-to-date, you can reduce the number of exceptions and manual interventions required in the invoice processing workflow. This, in turn, helps prevent delays and errors in processing.

3. Regularly monitor and optimize system performance

Implementing an invoice automation system is not a one-time task. To ensure ongoing success, it’s essential to regularly monitor and optimize your system’s performance. This involves tracking key metrics like processing times, exception rates, and straight-through processing (STP) rates.

By continuously monitoring these metrics, you can identify bottlenecks and areas for improvement in your invoice processing workflow. For example, if you notice a high number of exceptions related to a particular vendor or invoice type, you can investigate the root cause and take corrective action.

4. Ensure alignment between procurement and finance teams

Successful implementation of these tools requires careful alignment between procurement and finance teams. While finance teams might focus on features and cost savings, procurement teams often prioritize user experience and supplier adoption.

You need to ensure an alignment between these two diverse perspectives. This could be achieved with a cross-functional team with members from both teams or using shared KPIs that balance both their priorities.

This alignment is critical for addressing challenges like exception handling and capturing opportunities like early payment discounts, which can significantly impact your ROI.

5. Ensure data security and compliance

With the sensitive financial information involved in invoice processing, it’s essential to implement strict access controls, data encryption, and regular backups. It protect your business against data breaches and unauthorized access.

Additionally, ensure that your invoice automation solution complies with relevant industry regulations, such as GDPR or HIPAA. It is crucial for avoiding potential legal issues and maintaining trust with your vendors and customers.

Choosing an invoice automation solution that is compliant with relevant regulations can help mitigate security risks and ensure the integrity of your financial data.

6. Focus on data quality

Poor data quality can hinder the effectiveness of automation. You can ensure that your automated system operates efficiently by implementing robust data extraction tools and practices.

For instance, AI-powered OCR models better understand invoice layouts and fields and can even process invoices in different languages. It allows you to extract data accurately and with minimum fuss. Moreover, some of these tools come with database matching, allowing you to enrich extracted data by matching with external databases or tools and adding missing data.

This can reduce exceptions, improve straight-through processing rates, and enhance the overall effectiveness of your automated invoice processing system.

7. Develop clear exception-handling processes

Even with automation, some invoices may require manual intervention. So, establish clear procedures for managing exceptions. It can minimize disruptions and maintain efficiency.

For example, you might create a tiered system for handling exceptions, with clear guidelines for when to escalate issues. You could also implement regular reviews of exception cases to identify patterns and potential system improvements.

Developing clear exception-handling processes can reduce the time spent on manual interventions, improve consistency in problem-solving, and provide valuable insights for continuously improving your automation system.

Remember, introducing any new technology can be met with resistance. Openly communicate the benefits of automation to your AP team, emphasizing how it will free them from tedious tasks and allow them to focus on more strategic work. Provide thorough training and support to ensure a smooth transition and address any concerns about job security.

Unlike general software implementations, invoice automation affects multiple departments and external stakeholders. Therefore, extend your training to key suppliers, helping them understand how to submit invoices in the new system effectively.

Measuring the performance of automated invoice processing

Calculating the ROI of invoice automation is crucial for justifying the investment and ensuring that you’re getting the most value from your system.

Here are some key metrics to track and how to use them to calculate the ROI of your invoice automation implementation:

1. Processing time and efficiency

- Invoice cycle time: The total time from invoice receipt to payment

- Touch time: The amount of time spent manually handling each invoice

- Straight-through processing (STP) rate: The percentage of invoices processed without manual intervention

➡️

Average Invoice Cycle Time = Sum of all individual cycle times / Number of invoices

STP Rate = (Number of Invoices Processed without Manual Intervention / Total Number of Invoices Processed) x 100

2. Error rates and accuracy

Track the number of errors per invoice and the overall error rate to measure the impact of automation on accuracy.

Common errors to track include:

- Incorrect data entry

- Mismatched invoices and POs

- Duplicate payments

- Missed early payment discounts

➡️

Error Rate = (Number of Invoices with Errors / Total Number of Invoices Processed) x 100

3. Cost per invoice

Calculating the cost per invoice is essential for determining the financial impact of invoice automation. This metric takes into account all the costs associated with processing an invoice, including labor, technology, and overhead.

➡️

Cost per Invoice = Total Invoice Processing Costs / Number of Invoices Processed

4. On-time payment percentage

Track the percentage of invoices paid on time to measure the impact of automation on payment timeliness. This metric not only measures the impact of automation on payment timeliness but also reflects improved supplier relationships.

➡️

On-time Payment Percentage = (Number of Invoices Paid On or Before Due Date / Total Number of Invoices Paid) x 100

5. Early payment discount capture

Monitor the percentage of eligible early payment discounts captured. This is often an overlooked benefit of automation. Even capturing an additional 5% of available discounts can significantly impact your ROI.

➡️

Early Payment Discount Capture Rate = (Value of Early Payment Discounts Captured / Total Value of Available Early Payment Discounts) x 100

6. Return on Investment

To calculate the ROI of your invoice automation implementation, follow these steps:

- Determine the total cost of implementation, including software, hardware, training, and any consulting fees.

- Calculate the annual cost savings achieved through automation, considering:

- Reduced labor costs due to faster processing times and fewer manual interventions

- Eliminated late payment fees

- Captured early payment discounts

- Reduced error-related costs, such as duplicate payments or incorrect payments

- Use the following formula to calculate ROI

➡️

ROI = ((Annual Cost Savings – Total Implementation Cost) / Total Implementation Cost) x 100

For example, if your total implementation cost was $50,000 and you achieved annual cost savings of $75,000, your ROI would be: ($75,000 – $50,000) / $50,000 x 100 = 50%

This means that for every dollar invested in invoice automation, you’re seeing a return of $0.50 in the first year alone. Over time, as the initial investment is recouped, this ROI will increase significantly.

Remember, ROI isn’t just about immediate cost savings. Consider the long-term strategic benefits:

➡️

Improved decision-making: Real-time visibility into invoice data enables more informed financial decisions.

Employee satisfaction: Eliminating tedious tasks and reducing the time spent on troubleshooting and corrections leads to higher job satisfaction and reduced labor turnover.

By tracking these metrics and calculating your ROI, you can demonstrate the tangible value of invoice automation to stakeholders and make data-driven decisions about future improvements and investments.

Choosing the right automated invoice processing solution

With so many automated invoice processing solutions available on the market, it can be challenging to determine which one is the best fit for your business. Each solution offers different features, capabilities, and pricing models, making it essential to carefully evaluate your options before making a decision.

To help you navigate the selection process, here are some key factors to consider when choosing an automated invoice processing solution:

1. Functionality and features

Start by assessing your current invoice processing workflow and identifying the specific pain points you want to address with automation. Then, look for a solution that offers the features and capabilities that align with your needs.

Some key features to look for include:

- OCR and data capture accuracy

- Invoice matching and validation

- Approval workflow customization

- ERP and accounting system integration

- Reporting and analytics

- Mobile accessibility

2. Ease of use and user experience

The success of your invoice automation implementation largely depends on user adoption. Look for a solution with a user-friendly interface and intuitive navigation to ensure that your team can easily learn and use the system.

Consider factors like:

- Customizable dashboards

- Drag-and-drop workflow builders

- Contextual help and support

- Training resources and documentation

3. Integration capabilities

To maximize the benefits of invoice automation, it’s crucial to choose a solution that seamlessly integrates with your existing ERP, accounting, and other business systems. This ensures that data flows smoothly between systems, reducing manual data entry and errors.

Look for solutions that offer:

- Pre-built integrations with popular ERP and accounting systems

- Open APIs for custom integrations

- Secure data transfer and synchronization

4. Scalability and flexibility

As your business grows and evolves, your invoice processing needs may change. Choose a solution that can scale with your business and adapt to your changing requirements.

Consider factors like:

- Volume-based pricing models

- Modular architecture for adding or removing features

- Multi-entity and multi-language support

- Customizable exception handling workflows

- Support for diverse invoice formats and languages

5. Security and compliance

With the sensitive financial data involved in invoice processing, security and compliance are non-negotiable. Look for a solution that prioritizes data protection and adheres to relevant industry regulations.

Key security and compliance features to look for include:

- Role-based access controls

- Data encryption and secure storage

- Regular security audits and certifications (e.g., ISO 27001, SOC 2)

- Compliance with regulations like GDPR, HIPAA, and PCI DSS

6. Customer support and training

Implementing an automated invoice processing solution is not a one-time event. Ongoing support and training are essential for ensuring the long-term success of your implementation.

Look for a vendor that offers:

- Responsive customer support through multiple channels (e.g., phone, email, chat)

- Dedicated account management

- Regular software updates and enhancements

- Training resources

7. AI and ML capabilities

These features can significantly enhance the accuracy and efficiency of your invoice processing:

- Intelligent data extraction that improves over time

- Anomaly detection to flag potential fraud or errors

- Predictive analytics for cash flow management

- Automated coding and categorization of invoice line items

- Automated invoice-PO matching

8. Supplier adoption support

Getting suppliers on board with new invoice submission methods can be challenging. Look for solutions that offer:

- Supplier onboarding tools and resources

- Multiple options for invoice submission (e.g., portal, cloud storage, email, EDI) to accommodate various supplier capabilities

- Supplier performance analytics to track adoption and identify areas for improvement

💬

Comparing popular solutions in the market

To help you get started with your evaluation, here’s a comparison of some popular automated invoice processing solutions:

| Software/tool | Best for | Pricing | Free trial |

|---|---|---|---|

| Nanonets | SMBs & Enterprises looking for advanced automation using AI | 500 pages free, then $0.3/page | Yes |

| Airbase | Companies looking for a complete spend management platform with AP automation features | Custom pricing | No |

| BILL | Self-employed & small businesses | Starts from $45/month/user | No |

| Stampli | Small & mid-sized businesses with a focus on collaboration | Custom pricing | No |

| Tipalti | Managing global payments & complex tax requirements | Starts from $129/month | Yes |

| Ramp | Startups and small businesses looking for a free AP automation tool | Starts from $0/month/user | Yes |

| Freshbooks | Small service-based businesses that need simple invoicing capabilities | Starts from $19/month | Yes |

| Xero | Small businesses that use Xero accounting software | Starts from $29/month | Yes |

| Intuit Quickbooks | Small businesses that use QuickBooks accounting software | Starts from $18/month/user | Yes |

| SAP Concur | Large enterprises that use SAP ERP systems and want tight integration | Custom pricing | No |

How to implement automated invoice processing in your business

Start the process by assessing your current invoice workflow, identifying pain points, and setting clear, measurable goals aligned with your broader organizational objectives. Then, secure stakeholder buy-in by presenting a compelling business case highlighting potential ROI and proactively addressing concerns.

When choosing a solution, evaluate it based on the factors we identified in the previous section. Once you complete the purchase, form a cross-functional team, including members from AP, IT, and procurement, to plan the implementation.

Discuss with the software vendor to create a timeline for data migration and system integration. This will set the stage for a successful rollout of your new automated invoice processing system.

➡️

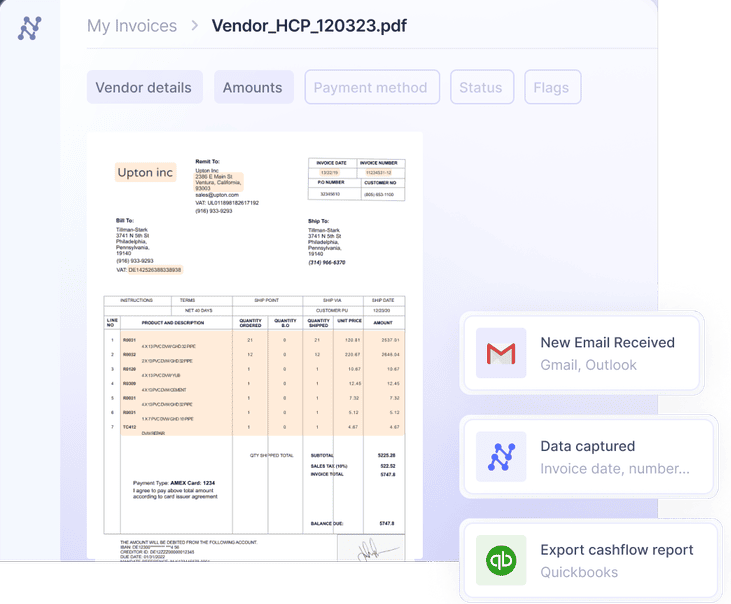

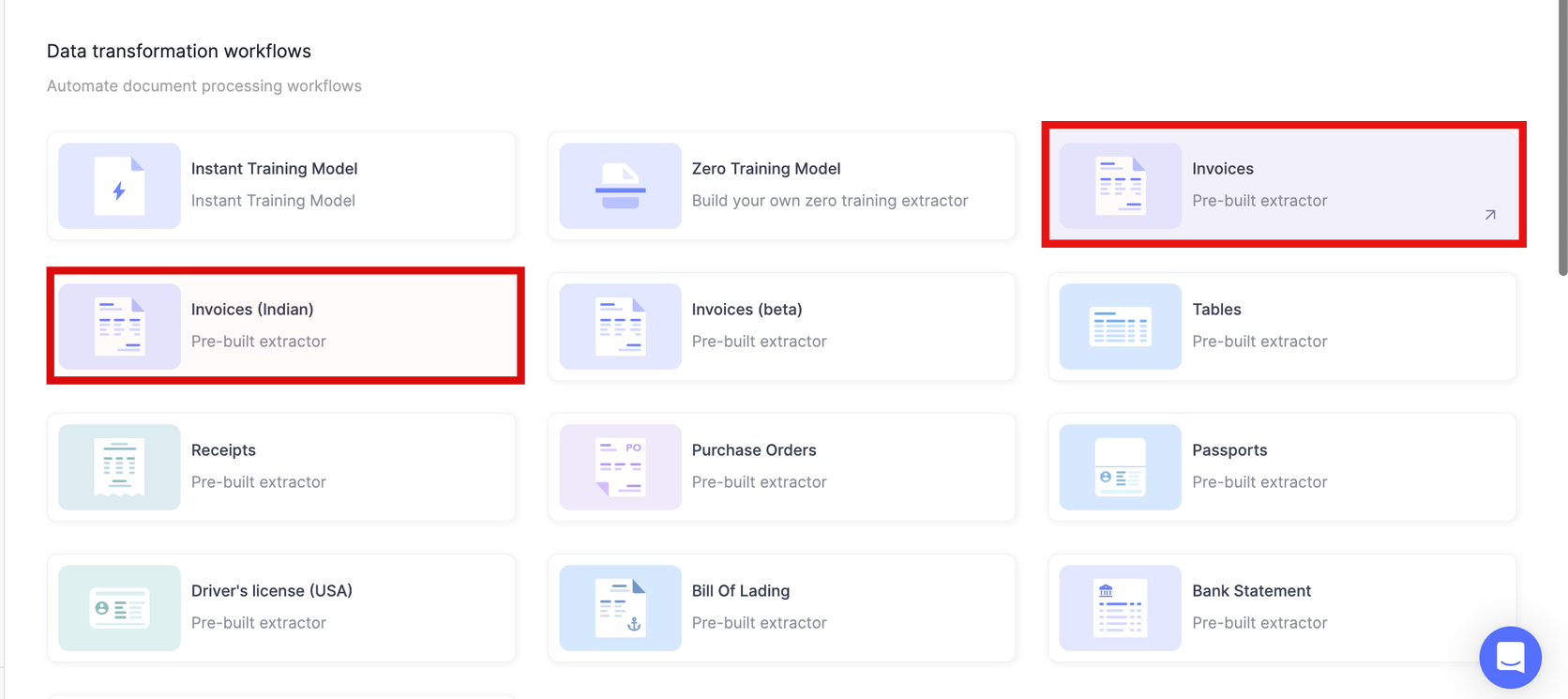

Here’s how to implement AI invoice processing using Nanonets as an example:

Step 1: Sign up for Nanonets and log in to your account.

Step 2: Once you’ve signed up and logged in, navigate to the ‘Workflows’ section. Choose the pre-built AI invoice processing model.

Step 3: Configure approval rules and stages based on your requirements. Assign approvers to review flagged invoices. This step is crucial for maintaining control and compliance in your invoice processing.

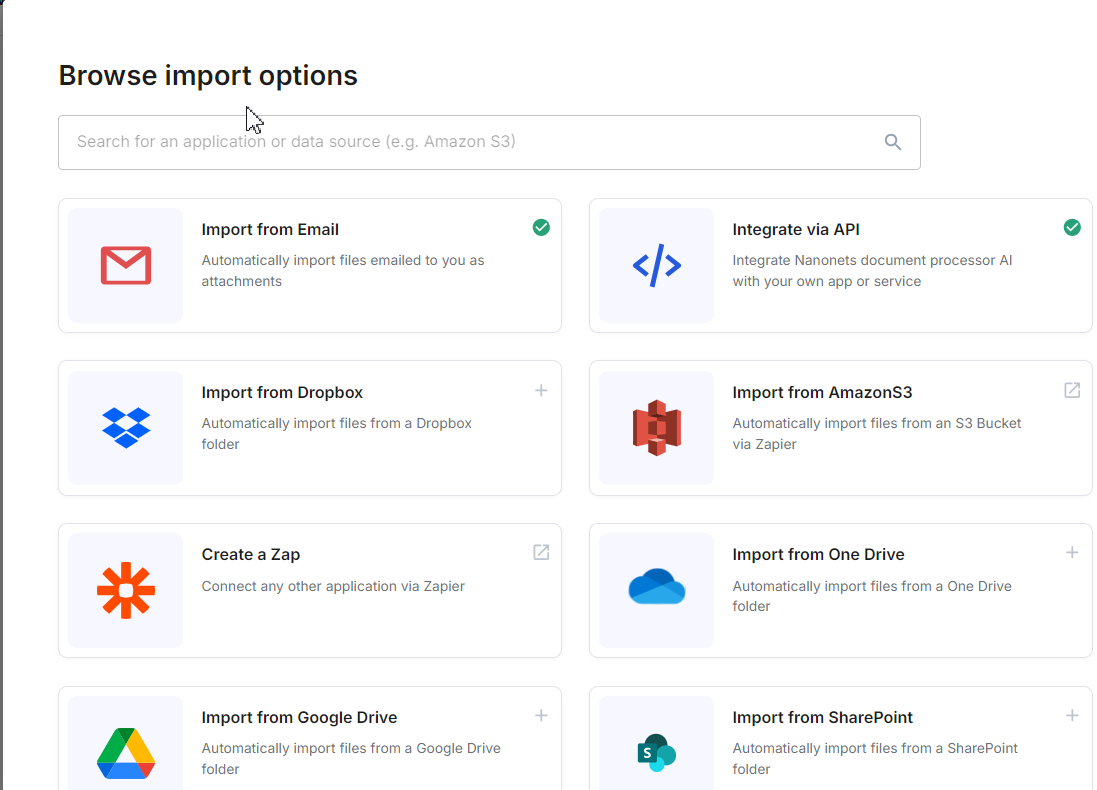

Step 4: Set up invoice input methods: upload locally stored invoices (PDFs, JPG, PNG, etc.) or import files from different sources such as email or cloud storage like Google Drive, OneDrive, or Dropbox. You can even automate invoice capture from designated email inboxes

Here’s a quick demonstration of how Nanonets extracts key data from a sample invoice

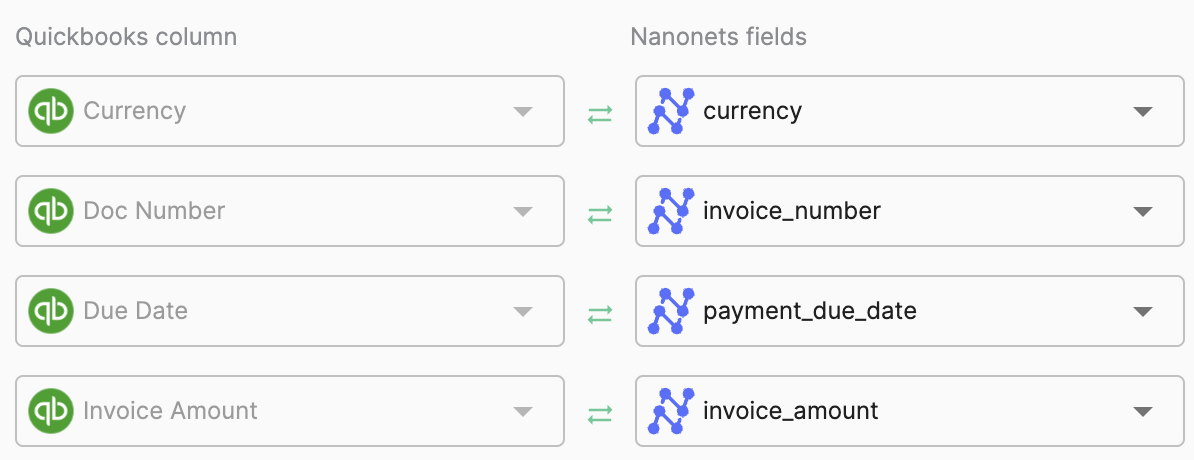

Step 5: The AI model automatically extracts crucial information such as vendor details, line items, and totals with exceptional accuracy. Review the extracted data and make necessary adjustments. Each correction you make improves model performance.

Step 6: Configure the automatic export and real-time synchronization of approved invoices to your accounting software or ERP. Nanonets integrates with QuickBooks, Xero, SAP, and more. You can also manually download the data in various formats or share it directly with team members. You can even automatically create journal entries in your accounting software or update inventory levels based on invoiced items.

By following these steps, you can implement an automated invoice processing system that offers numerous benefits:

- No-code platform, making it accessible to non-technical users

- Highly accurate data extraction, even for complex invoice formats

- Continuous learning and improvement based on user feedback

- Robust security measures, including SOC-2 certification and GDPR compliance

- Flexible integration options with existing accounting and ERP systems

- Prebuilt AI invoice processing model that accurately extracts key information fields, such as vendor names, invoice numbers, and totals, out-of-the-box

- Customizable AI models that can be trained on your specific invoice formats and data requirements

💬

Remember, successful automation isn’t just about technology – it’s about transforming your entire approach to invoice processing. Be prepared to adapt your workflows to fully harness the power of your new system.

While automation will handle most invoices, exception management remains crucial. Ensure your team is equipped to efficiently handle these cases, using each instance as an opportunity to further enhance the system.

Great product and customer support. – 10/10 would recommend!

“Nanonets is able to reference our significant list of unique product lines and assign them to the correct GL in Quickbooks and other systems. All while maintaining above 90% accuracy without our team having to touch anything. It has saved us countless hours of data entry.”

— Kale F., Director of DVM Office, in a review on G2.